(Continued from previous article)

The world is today speaking of “Data Driven Organizations”. Essentially, this means that “Data Engineering” is used to increase the productivity of companies. There could be several ways by which “Data” can help a company to earn revenues beyond the simple observation that “Better quality”, “More accurate” and “More innovatively processed” data can improve the productivity.

Recently Zomato made a public issue of shares and raised Rs 9750 crores. The company had accumulated losses of over Rs 4211 crores in the last three years but investors were prepared to buy its shares at a fantastic price of Rs 76 per share and it is now traded in the stock markets at a higher value than at which Vodafone global shares are traded…around Rs 130 over 120.

The magic here is the monetization of the perception that Zomato has data about its customer’s eating habits which when filtered through an efficient data analytics system can enable the company to improve its earnings in the next 10 years and turn it around into a profitable company. For Zomato which is still not able to show a profitable stream the projections that “It has data that can be monetized and share holders can take that future potential for current valuation” may be a highly speculative proposition. But for Vodafone which has a global potential proven for many years, any such thought that its data is valuable and can be monetized better is a certainty.

If Vodafone floats a tender for Big data companies to make proposals on how its data can be monetized, then they will be surprised to know that the data of 27 crore customers and their behavioral pattern can generate very interesting proposals.

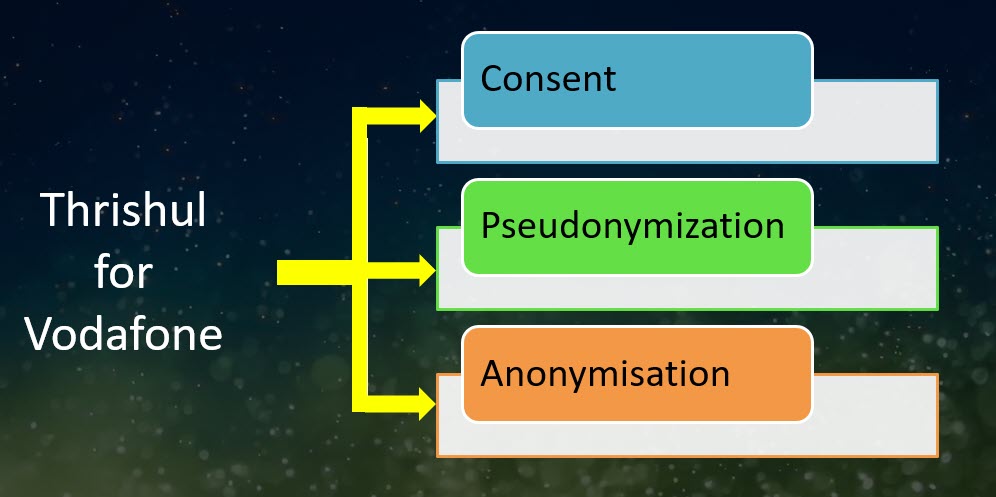

Let me make one point clear here… The exploitation of data of its customers by Vodafone will involve “Privacy” issues. But “Consent”, “Pseudonymization” and “Anonymisation” can be the “Trishul” with which Vodafone can prime its data holding for monetization even considering the upcoming Personal Data Protection Act of India.

We may recall that American Airlines, USA valued its frequent flyer customer base (AAdvantage) at around us$ 19.5 to 31.5 billion last year. Similarly the United Airlines also revalued its loyalty program data at about $ 20 billion. Caesar Entertainment cashed its total rewards customer data base for over $ 1 billion during a bankruptcy proceedings.

If these valuations were acceptable to investors then it is possible that post-Zomato success, revaluation of data of Vodafone could raise enough money to not only clear Vodafone’s AGR dues but perhaps its entire debt.

If Vodafone does not know the value of its data and the potential, I urge the Government to take a pledge of Vodafone customer data for AGR dues and create a SPV to monetize the data value. It may be able to realize much more than the AGR dues.

Will the Telecom Minister consider such a possibility?

Naavi