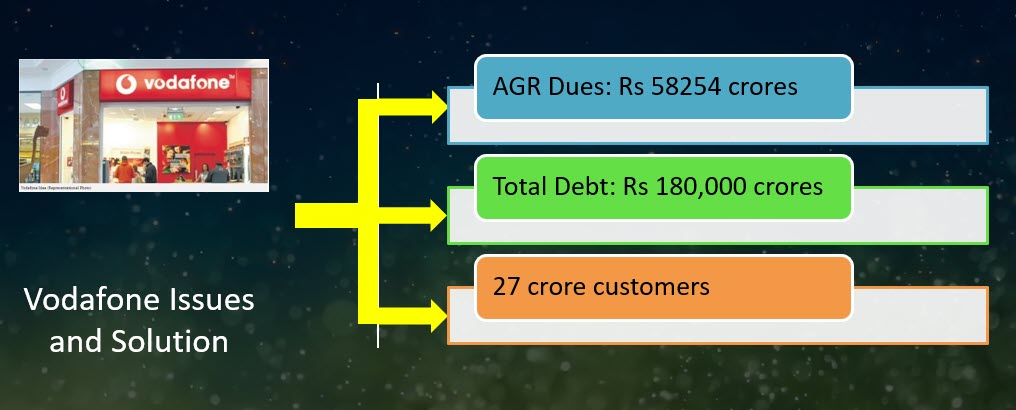

Vodafone is facing a financial crisis. (Refer article in New Indian Express) A company which has 270 million customers is in financial crisis and is unable to face the loss arising out of the Supreme Court decision which had made it liable for payment of substantial dues to the DOT. Even a 10 year spreading out of the repayment appears to be insufficient for Vodafone to come out of the crisis.

Vodafone is facing a financial crisis. (Refer article in New Indian Express) A company which has 270 million customers is in financial crisis and is unable to face the loss arising out of the Supreme Court decision which had made it liable for payment of substantial dues to the DOT. Even a 10 year spreading out of the repayment appears to be insufficient for Vodafone to come out of the crisis.

According to information available, Vodafone woes Rs 58,254 crores to the Government as AGR dues of which it has paid Rs 7854 crores. This is the annual license fees and spectrum usage charges which the company failed to factor in its operations earlier due to a wrong advise it received from its financial and legal professionals.

It is said that Telecom operators interpreted that they would be charged the license fee on the basis of their core business conducted using the spectrum while DoT held that the definition of AGR included items like dividend, interest, capital gains on account of the profit from the sale of assets and securities and gains from foreign exchange fluctuations.

It is futile now to discuss the legality of the issue since the Supreme Court has settled it in favour of the DOT. The telecom operators together are guilty of not having provided for this possibility while they made merry during all these days under the mistaken interpretation.

However, this is not the time to gloat over who was right and who was wrong. We need to look at ways by which the issue could be resolved because the damage that a failure of a big company like Vodafone could cause to the economy is immense and is avoidable.

The per-capita burden of Vodafone dues of Rs 58000 crores on 27 crore subscribers is about Rs 2000 per customer. Current share price of Vodafone is around 120 per share.

If there is a further issue of shares at around Rs 100 per share, the dues can be met with an issue of 20 shares per customer as “Rights”. (Technically it could be called a Private Placement). This issue of 540 crore new shares would dilute the share holding by 20% but can enable the company to sail over the current difficulty and increase the P/E multiple so that the loss could be adequately compensated.

While the above thought is a traditional thought, there is a more exciting thought based on the new concept of “Value of Data as an Asset” which we shall discuss separately in the following article.

Naavi