Data unquestionably has value and we the professionals need to discover it. Once discovered, we need to ensure that it is properly disclosed to the stake holders. This “Discovering” and “Uncovering” are the twin objectives of promoting the DVSI.

To discover the data we need to understand the nature of data as an asset and how does its value accumulate. To uncover this value, we need to device a method of representing the value in the Balance sheet.

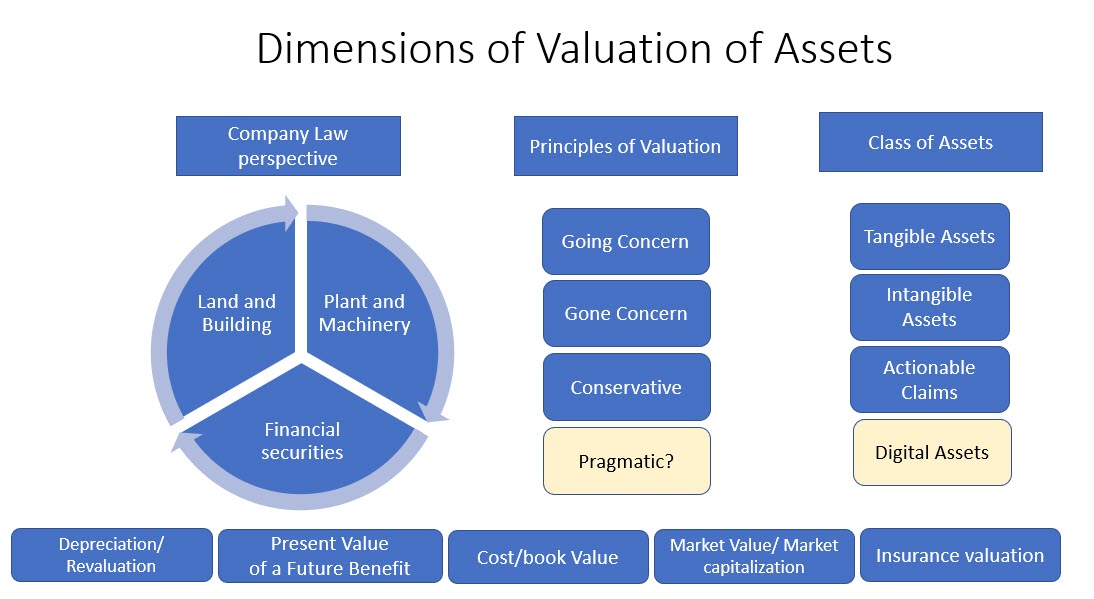

In legacy accounting practices, we differentiate assets in a Company firstly on the basis of whether they are meant to be used for long term benefit of the company by being a tool of creating other assets which are produced and exchanged for cash. The Fixed assets are those assets which are the tools and current assets are the assets which get modified during the process and gets converted from raw material to work in progress to finished goods to debtors and then cash. At the end of the process, current assets no longer remain in the company and gets converted into cash.

Fixed assets may have a useful life and hence are valued at cost plus maintenance minus depreciation. Some fixed assets like land may not depreciate and may even appreciate in value. They can be revalued but the principle of conservative accounts normally does not practice revaluation.

Fixed assets may have a useful life and hence are valued at cost plus maintenance minus depreciation. Some fixed assets like land may not depreciate and may even appreciate in value. They can be revalued but the principle of conservative accounts normally does not practice revaluation.

Accountants also use the principle of “Going Concern Valuation” and “Gone Concern Valuation” to chose if they can take the market value of some of the assets into consideration instead of the cost. Conservative principle adopts cost or market value which ever is less. In a Gone concern approach, the assets may not be considered as capable of being further processed into value added products and are valued mostly at the distress sale value. In a going concern the optimistic approach to valuation is adopted under the presumption that even if the assets are sold, the purchaser will continue to be in business and hence the assets will continue to reap their value as they have in an ongoing operation.

While assets like land, Building, Machinery, Stocks etc are tangible assets, there are assets like “Contractual Receivables not related to sales of finished products” which are considered “Actionable Claims”, meaning that money may be recoverable through some action.

There are other assets such as “Goodwill”, “Trademark”, Copyright”, “Patent” which are considered “Intangible Assets”. Accounting standards have been developed to incorporate “Intangible Assets” into the books of account though “Conservative Principles” prevent “Internally Created Intangible Assets” at being considered on par with bought out intangible assets.

When we look at valuing “Data” we need to keep in mind all these principles of asset valuation but apply them to “Data” with a proper understanding of the nature of data. It is here that the “Theory of Data” comes to our assistance in building more clarity to the nature of data, whether it is a “Property” in the normal sense and what are the nuances in assigning value to data.

Data is “Dynamic” and undergoing a constant metamorphosis. Today data may look like a caterpillar but in two days it may become a beautiful butterfly and in another few days, it may cease to exist. Assigning the value to data needs to take into account the different avatars in which data may find itself in at a point of time.

A normal tangible asset when sold transfers itself from the custody of the first owner to the other owner. Seller therefore does not have the possession of the asset, though he may realize its value one time.

In the case of “Intangible Assets” it may be possible to “License its use” to a third party and still retain partial or complete ownership. The licensee also may get one time license or multiple use license or perennial use license. The valuation may depend on the terms of use. Any IPR related intangible asset does undergo dilution of its value on licensing to multiple parties and hence undergoes a gradual erosion of value like a depreciated fixed assets.

Data is a unique kind of asset which has its own characteristics. Unlike a tangible asset, it can get replicated and sold to multiple persons. It may some time depreciate in value if the data is considered “Confidential” but in certain cases it may not depreciate. It may even gain value through aging.

In a data business like say Twitter, data keeps on adding and creates a platform like a reservoir. On that reservoir advertising revenue gets generated. Larger the expanse, deeper reservoir, higher is the advertising revenue like larger boats being able to travel farther on the reservoir earning higher income. The value of data accumulated in the reservoir therefore has an expression in terms of revenue of the boat operator. In such situations, the Data Valuer has to consider the “Cost of Acquisition” as different from “Revenue Potential” of the accumulated asset. It is in such instances that the distinction between the value of data as an asset and the value of the data enterprise becomes hazy and Data Valuers need to device the Standards like DVSI so that there is some uniformity in approaching the valuation exercise.

Uncovering the Value of Data by disclosing it in the balance sheet needs to take into account the reliability and larger acceptability of the valuation methodology.

It would be easy to add the value of data as a Footnote in the financial statement or as a “Contra Entry” on both sides of assets and liabilities. But if we need to add the value of data as a separate “Data Class” in the financial statements, then the reliability of the valuation methodology has to be at a high level.

However, until such time as the universe of professionals are not agreeable to a standard like DVSI, analysts may compute their financial ratios omitting the data asset appropriately from the computation of their Debt Equity Ratio or Current Ratio, Asset Turnover ratio etc.

Naavi